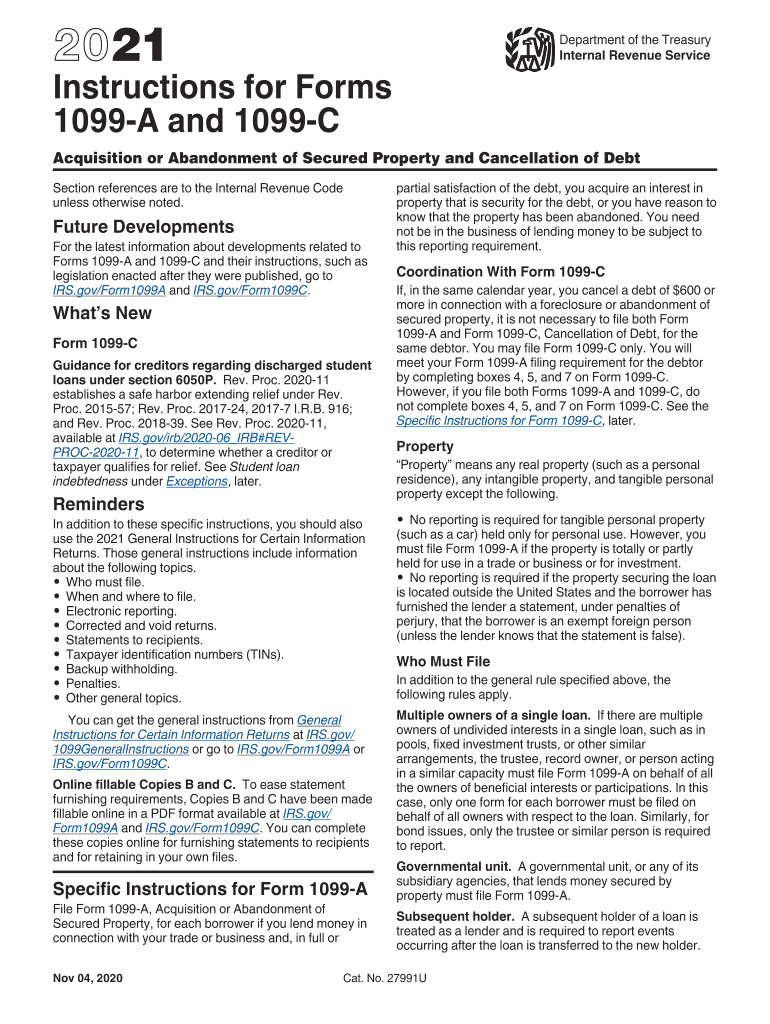

May 09, 21 · "Instructions for Forms 1099A and 1099C ()," Page 1 Accessed Aug 17, IRS "Instructions for Forms 1099A and 1099C ()," Pages 12 Accessed Aug 17, IRS "General Instructions for Certain Information Returns ()," Page 26 Accessed Aug 17, IRS "Form 1099A Acquisition or Abandonment of Secured Property (Mar 13, · Posted March 13, Can't find a form to download for a 10c Cancellation of debt Does one exist under a different name or am I putting it on line 8, Sch 1 other income and entering it myself?Jun 01, 19 · 1099C for deceased spouse Assuming the Form 1099C's tax year states 16 and if she had an estate established, then the estate would be responsible for paying the tax on the income In the absence of an estate, then you have nothing to report

1099 Misc Form Fillable Printable Download Free Instructions

What happens if you get a 1099-c

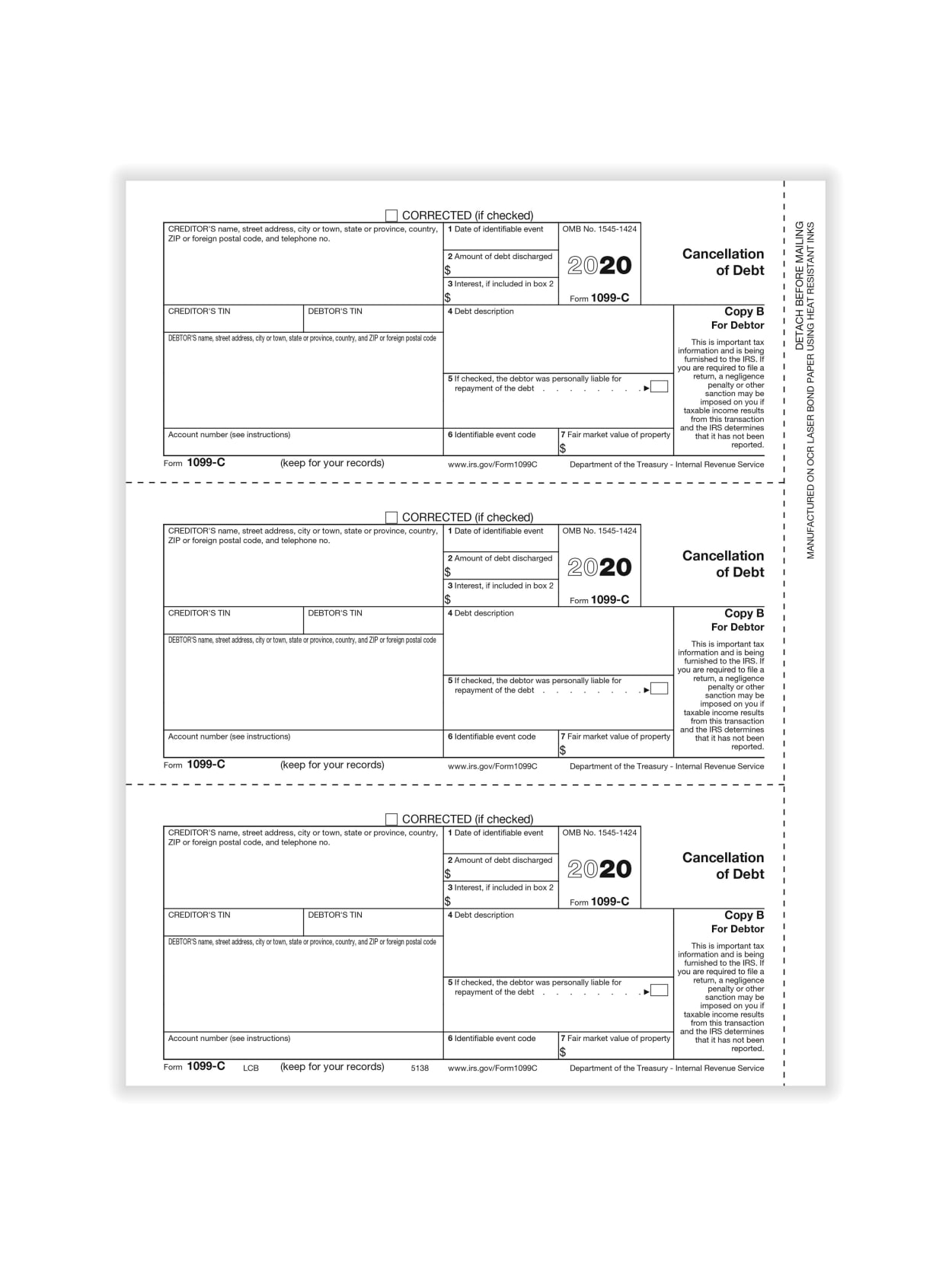

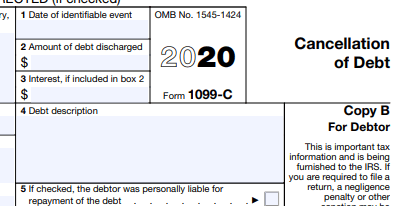

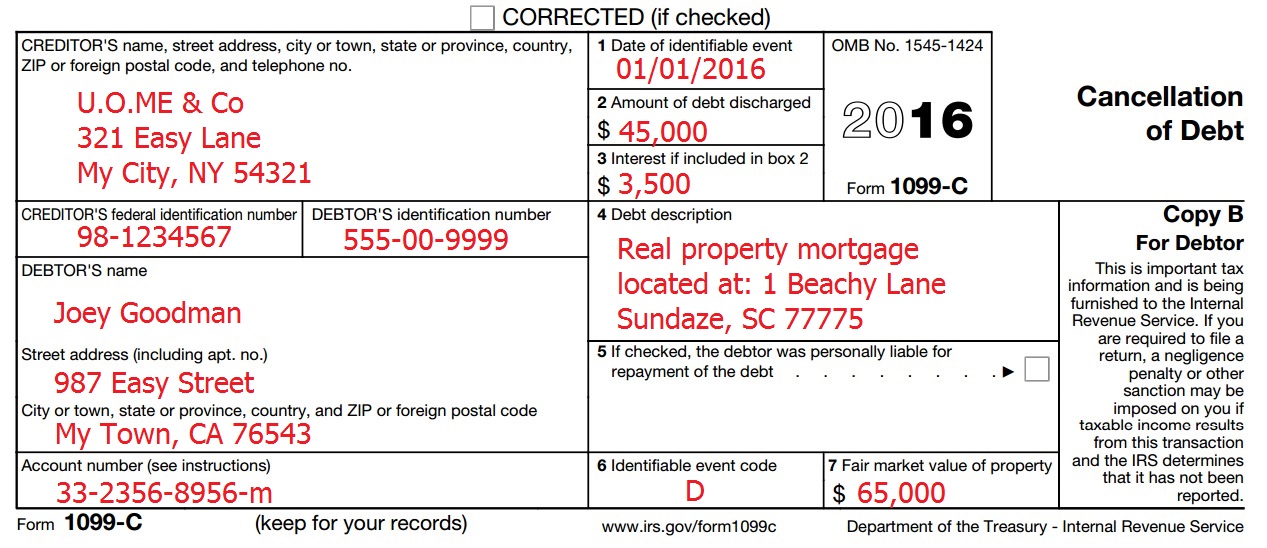

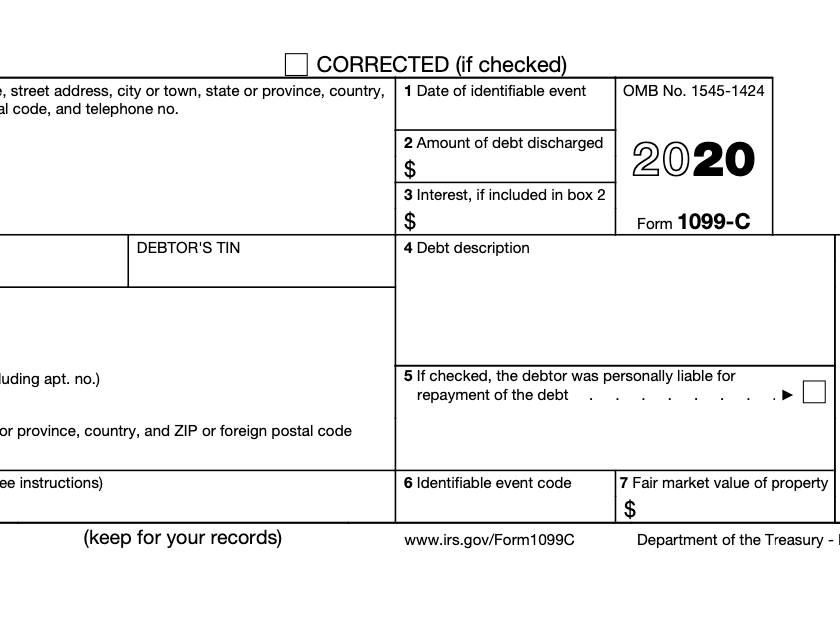

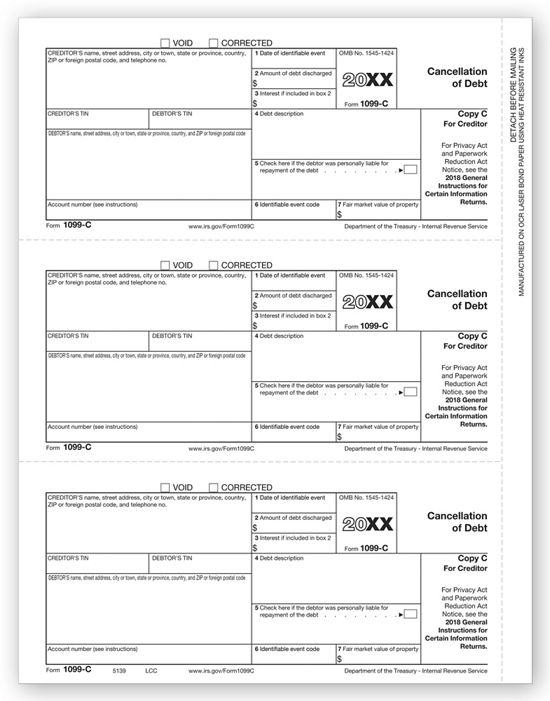

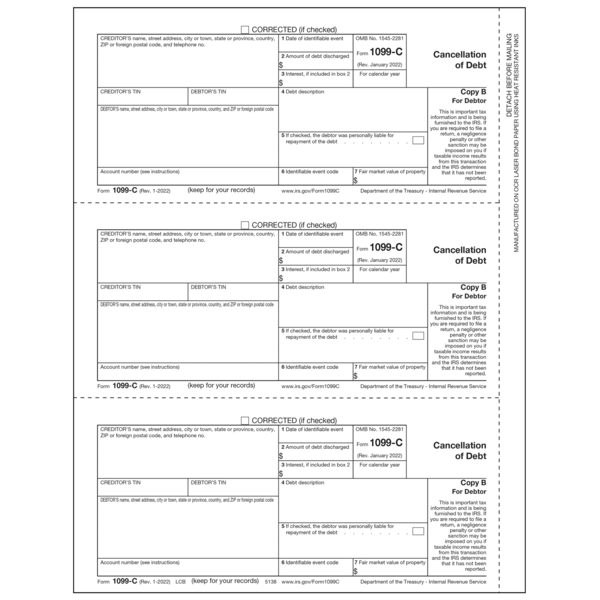

What happens if you get a 1099-c-Feb 01, 21 · 1099C Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determinesSelect the type of canceled debt (main home or other) and then select Continue;

Receiving A 1099 C After Bankruptcy Garcia Gonzales P C

Enter the "Cancelation of debt (1099C)" code 6 under the Cancelation of Debt subsection (this amount is typically found on Form 1099C, box 2To verify, see the computation below)If one of your creditors canceled a debt you owe, you'll likely receive a Form 1099C this year A number of exceptions and exemptions can eliminate yourMar 13, 19 · To file an amended return, start with IRS form 1040X (link opens PDF) Adjust your taxable income to include the amount of forgiven debt, and explain in

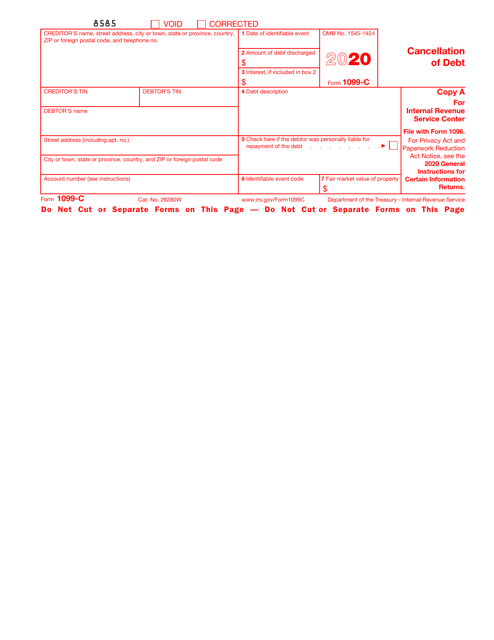

The 1099C is an IRS form that is used to report "Other Income" from canceled or forgiven debt over $600 A lender who cancels debt over $600 will generate a 1099C and send it to both the IRS and youFeb 04, · February 4, Did you know that the IRS considers any forgiven debt as a source of income and that taxes must be paid on that "revenue" And if you've ever settled a debt for less or had debt forgiven completely, you've likely received a surprise in the mail coming tax season the Form 1099However, it did not take me to where I need to enter the information from the 1099C

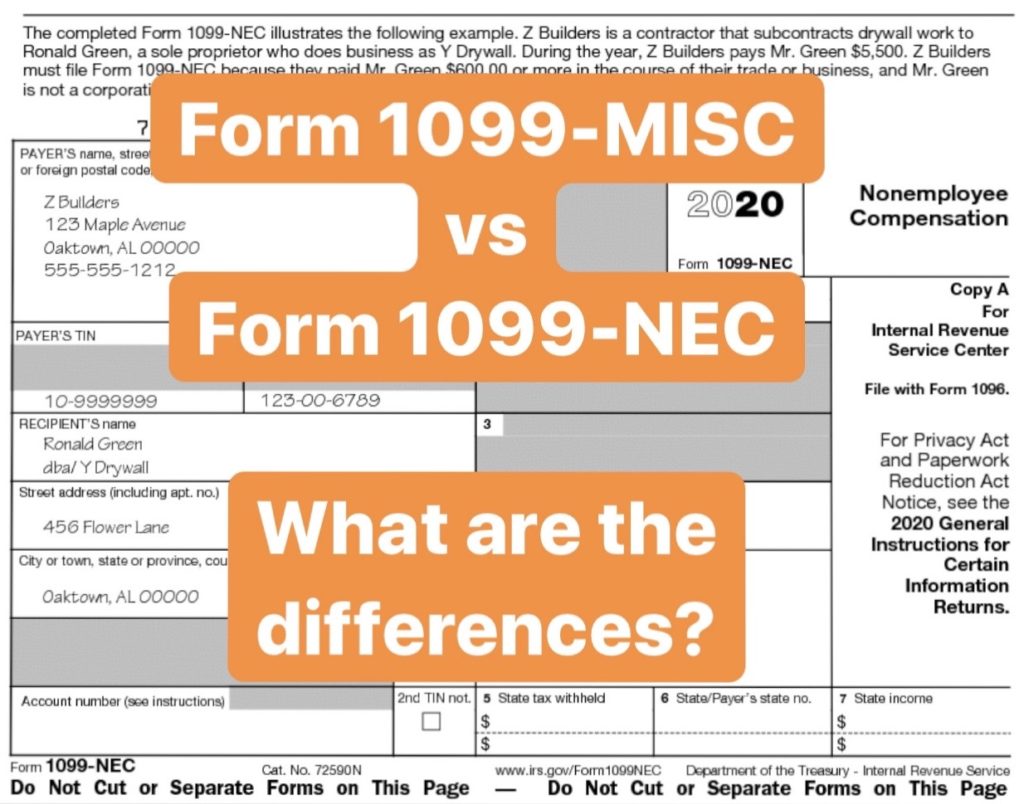

Apr 08, · What to know about Form 1099C and cancellation of debt If you've received at least $600 in forgiveness for your student loans , you'll be sent a Form 1099C by your creditor The student loan forgiveness form will include the following informationNew for tax year 1099NEC, nonemployee compensation Read more An information return is a tax document that banks, financial institutions, and other payers send to the IRS to report payments paid to a nonemployee during a tax yearApr 19, 21 · 1099C forms cause a lot of people huge amounts of worry and stress Most of that worry is unwarranted or overblown, fortunately SHARE Tweet Share Share Reddit Email Kemal Yildirim / E / Getty Images by Sally Herigstad, and Dan Rafter April 19, 21 Advertiser Disclosure Filed Under Expert Q&A

1099 C Cancellation Of Debt A Complete Guide To The 1099 C Credit Com

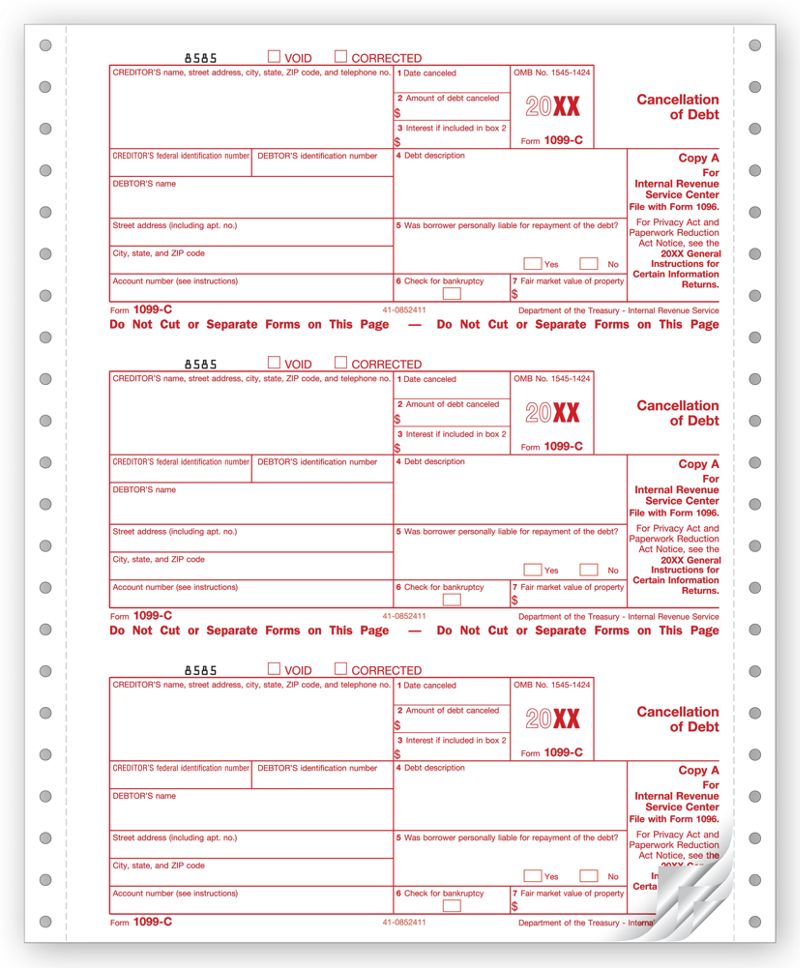

Continuous 1099 C 4 Part Carbonless Deluxe Com

Feb 09, 21 · Update Due to the pandemic, the IRS has extended the tax deadline for the tax year from April 15, 21 to May 17, 21 This only applies to individual federal income returns and tax payments, not a state's income tax deadline, including state payments or depositsApr 16, 09 · According to the update of IRS Office of Research Publication 6961, more than 39 million 1099C forms will be filed covering the tax yearSep 14, · But even if they processed the payment in January of the 1099C should be issued for the tax year and not 21, even though you would receive it in 21 Form 1099 Correction Process Call the IRS and have an IRS representative initiate a Form 1099 complaint The IRS will fill out form 4598, "Form W2, 1098, or 1099 Not Received

What Is A C Corporation What You Need To Know About C Corps Gusto

:max_bytes(150000):strip_icc()/Screenshot31-f811e886d8fd4dc183e95ee360004fb3.png)

Irs Form 1099 A What Is It

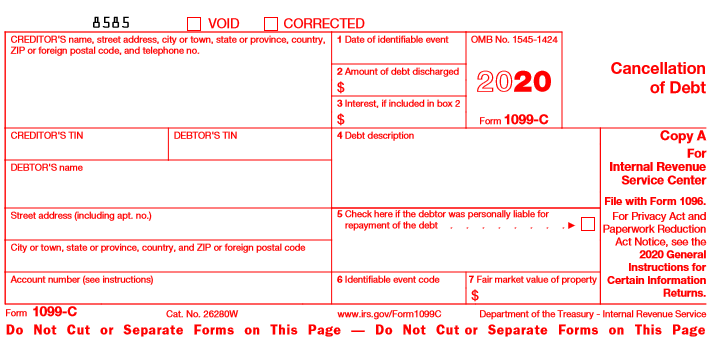

Form 1099B Proceeds from Broker and Barter Exchange Transactions (Info Copy Only) Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099CAPIn most situations, if you receive a Form 1099C from a lender after negotiating a debt cancellation with them, you'll have to report the amount on that form to the Internal Revenue Service as taxable income Certain exceptions do apply The federal tax filing deadline for individuals has been extended to May 17, 21Read our exhaustive guide, which contains a lengthy FAQ, and can help you move forward

1099 Nec Tax Forms Discount Tax Forms

What Are Irs 1099 Forms

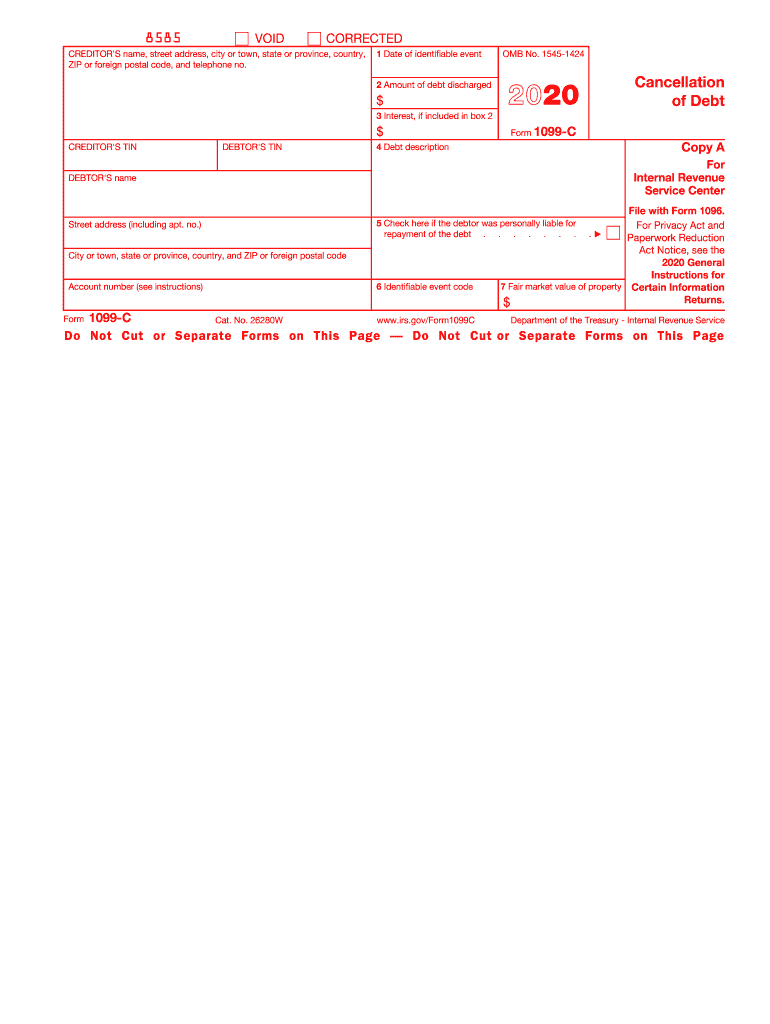

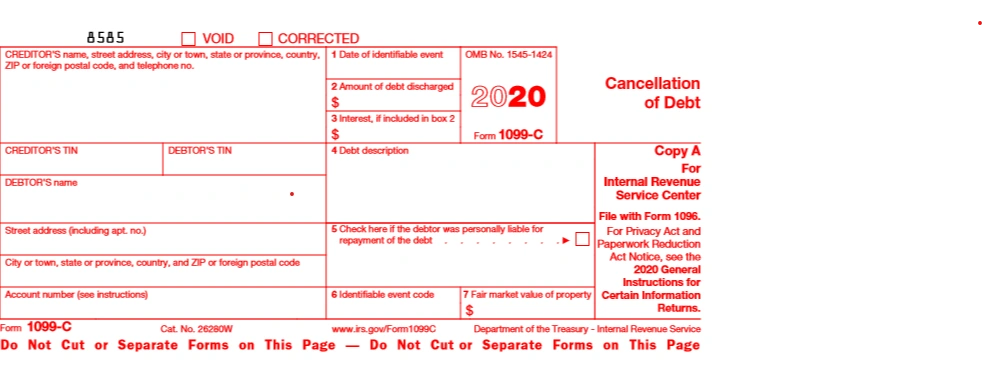

Form 1099C is used to report a canceled or forgiven debt of $600 or more The lender submits the form to the IRS and to the borrower, who uses the form to report the canceled debt on his or herInst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 21 Inst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions 21Enter Box 1 (1099A) in Box 1 (1099C) Generally, enter Box 2 (1099A) in Box 2 (1099C) However, if the amount of debt canceled is different from the amount reported in Box 2 of your 1099A, enter the amount of debt actually canceled Your lender can tell you this amount Enter any accrued interest that was canceled in Box 3 (1099C)

Form Irs 1099 C Fill Online Printable Fillable Blank Pdffiller

1099 C Cancel Of Debt Laser Fed Copy A Item 5137

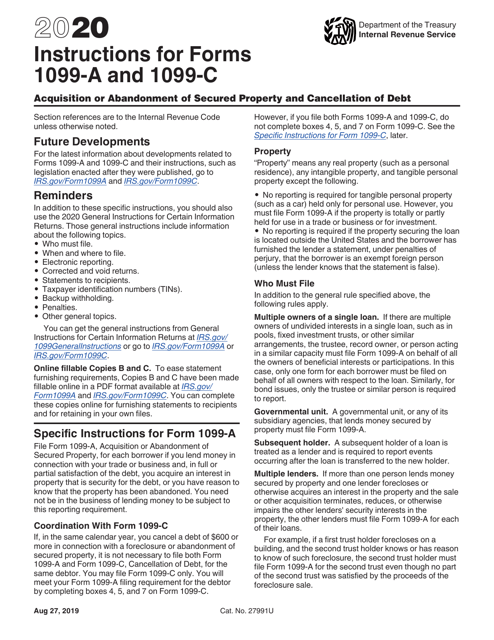

Link to post 1099 c Theme Default (Default) CompressedMar 24, 21 · Information about Form 1099C, Cancellation of Debt (Info Copy Only), including recent updates, related forms, and instructions on how to file File 1099C for canceled debt of $600 or more, if you are an applicable financial entity and an identifiable event has occurredYou may file Form 1099C only You will meet your Form 1099A filing requirement for the debtor by completing boxes 4, 5, and 7 on Form 1099C However, if you file both Forms 1099A and 1099C, do not complete boxes 4, 5, and 7 on Form 1099C See the

Debt Collector 1099 C

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Dec 01, · Nicole Dieker 12/1/ If you have a 1099C form but did not include the forgiven debt as taxable income, you can file an amendment to your tax return Use Form 1040X,Mar 16, 21 · If your debt is canceled or forgiven, you'll receive Form 1099C (Cancelation of Debt) Note If you received a 1099C for your main home and another 1099C for something else (like a credit card, car loan, or second mortgage) you won't be able to use TurboTax, as we don't support this To enter your 1099C Open or continue your return, if it isn't already openThere was no estate when he passed and things have changed the past years

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 19 Inst 1099A and 1099C Instructions for Forms 1099A and 1099C, Acquisition or Abandonment of Secured Property and Cancellation of Debt 18 Inst 1099A and 1099CApr 29, 21 · In she received a 1099C for the Cancellation of a credit card debt in her husband's name The Code on the 1099C is G, indicating the cancellation was due to a policy to discontinue collection It seems unreasonable for the spouse to be responsible for tax on the sum forgiven The client has very limited financial resourcesWithin a 1040 return, there is not a specific IRS 1099C input form to fill in Instead, depending how the cancellation of debt is to be treated, there are a few options you have in order to get this to flow correctly to your return Method 1 To have the amounts from the IRS 1099C flow to the 1040 line 21 as other income

1099 C Cancellation Of Debt Debtor Copy B 3up

The Timeshare Tax Trap 1099 C Questions Answered

Do not file Form 1099C when fraudulent debt is canceled due to identity theft Form 1099C is to be used only for cancellations of debts for which the debtor actually incurred the underlying debt CAUTION!2Instructions for Forms 1099A and 1099C ()Form 1099C Cancellation of Debt Copy B For Debtor Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you ifJun 06, 19 · I'm doing my 19 taxes not I was able to select the Jump to link to download the 1099C I answered the the following questions On the Tell us about your canceled debt screen, select Yes;

How A 1099 C Affects Your Taxes Innovative Tax Relief

Amazon Com 1099 Nec Tax Forms Replaces 1099 Misc For 4 Part Form Sets For 5 Vendors 2x 1096 Summary And Confidential Envelopes Filings For 5 Office Products

Dec 12, 19 · Internal Revenue Service "About Form 1099C" Accessed Jan 17, Internal Revenue Service "Canceled Debt Is It Taxable or Not?" Accessed Jan 17, Internal Revenue Service " Instructions for Forms 1099A & 1099C" Accessed Jan 17, Internal Revenue Service " Form 1099C" Accessed Jan 17, 19 Internal RevenueIf your lender agreed to accept less than you owe for a debt, you might get a Form 1099C in the mail Alternatively, your lender might automatically discharge the debt and send you a Form 1099C if it's decided to stop trying to collect the debt from youForm 1099C, call the information reporting customer service site toll free at or (not toll free) Persons with a hearing or speech disability with access to TTY/TDD equipment can call (not toll free)

1099 Misc Form Fillable Printable Download Free Instructions

I Just Got A 1099 C Form For A Debt From 16 Years Ago

If a Form 1099C Cancellation of Debt for canceled debt is issued to an S Corporation, the income inclusion (or exclusion) is applied at the corporate level If applicable, the corporation would then file Form 9 Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 10 Basis Adjustment) with their tax return to report any tax attribute reductionsMar 12, · In this blog post, we will discuss the 1099C form Talk to us for FREE to learn about your options What is a 1099C tax form?A 1099C is a form used to report various types of income It's one of several 1099 forms that are used to report income that isn't reported on W2 forms

Forms 1099 C And 1099 A Cute766

Complyright 1099 C Tax Forms Debtor B 150pk Office Depot

Dec 04, · A 1099C is used when you have debt canceled or forgiven When will I get a Form 1099C?Complete IRS 1099C online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documentsInst 1099B Instructions for Form 1099B, Proceeds from Broker and Barter Exchange Transactions Form 1099C Cancellation of Debt (Info Copy Only) 21 Form 1099C Cancellation of Debt (Info Copy Only) 19 Form 1099CAP

Nagforms Laser 1099 Nec Payer State Copy C 100 Pk Neclmc

1099 C Cancellation Of Debt H R Block

Jan 30, · This month, , I received a 1099 C for the cancellation of debt, in his name only I am in a community property state, am I responsible to file this for ?Scroll down to the Alimony and Other Income section;Efile Form 1099C Online to report the Cancellation of debt Efile as low as $050/Form IRS Approved We mail the 1099C copies to your debtor

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Irs Instruction 1099 A 1099 C 21 Fill Out Tax Template Online Us Legal Forms

Apr 07, · If you had any debts canceled or expect to receive a 1099C, you may want to work with a professional tax service to file your taxes What Is a 1099C Cancellation of Debt?Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor If you are selfemployed,Dec 30, · Do you have 1099C cancellation of debt questions?

Receiving A 1099 C After Bankruptcy Garcia Gonzales P C

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

May 06, 21 · IRS Form 1099C is an informational statement that reports the amount of and details about a debt that was canceled You can expect to receive the form from any lender that has forgiven a balance you owe, no longer holding you liable for repaying itFeb 25, 21 · Receiving a 1099C should always mean the debt is canceled and no longer subject to collection But it may be up to you to make sure Until 16, IRS rules allowed creditors to file a 1099C if no payments had been made on a debt for 36 months This resulted in many 1099C forms being issued for debts that were delinquent but not actually forgivenMar 24, 21 · Follow these steps to report a 1099C Cancelation of Debt Go to Screen 141, SS Benefits, Alimony, Miscellaneous Inc;

What Is An Irs Schedule C Form And What You Need To Know About It

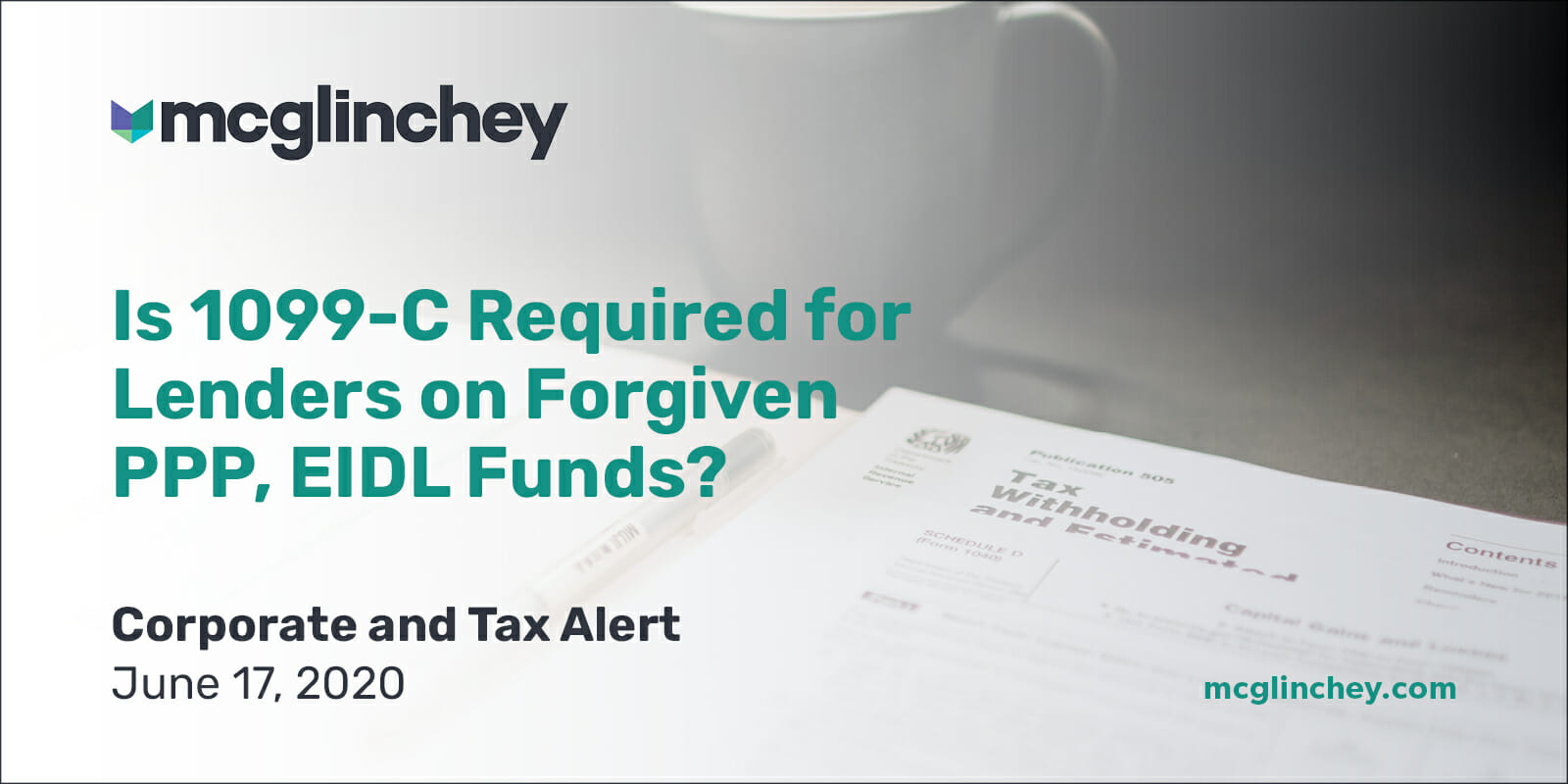

Is 1099 C Required For Lenders On Forgiven Ppp Eidl Funds Mcglinchey Stafford Pllc

Complete IRS 1099C 21 online with US Legal Forms Easily fill out PDF blank, edit, and sign them Save or instantly send your ready documents

When Is Canceled Debt Taxable Freedom Law Firm

1099 C Defined Handling Past Due Debt Priortax

:max_bytes(150000):strip_icc()/Screenshot39-fb0ecf0139834b37943efafda8ef09b4.png)

Irs Form 1099 C What Is It

Accessing Your 1099 G Sc Department Of Employment And Workforce

Download Instructions For Irs Form 1099 A 1099 C Acquisition Or Abandonment Of Secured Property And Cancellation Of Debt Pdf Templateroller

What Does A 1099 C Cancellation Of Debt Mean

The 1099 C Tax Consequences Of Debt Settlement South Florida Reporter

Irs Form 1099 C Software 79 Print 2 Efile 1099 C Software

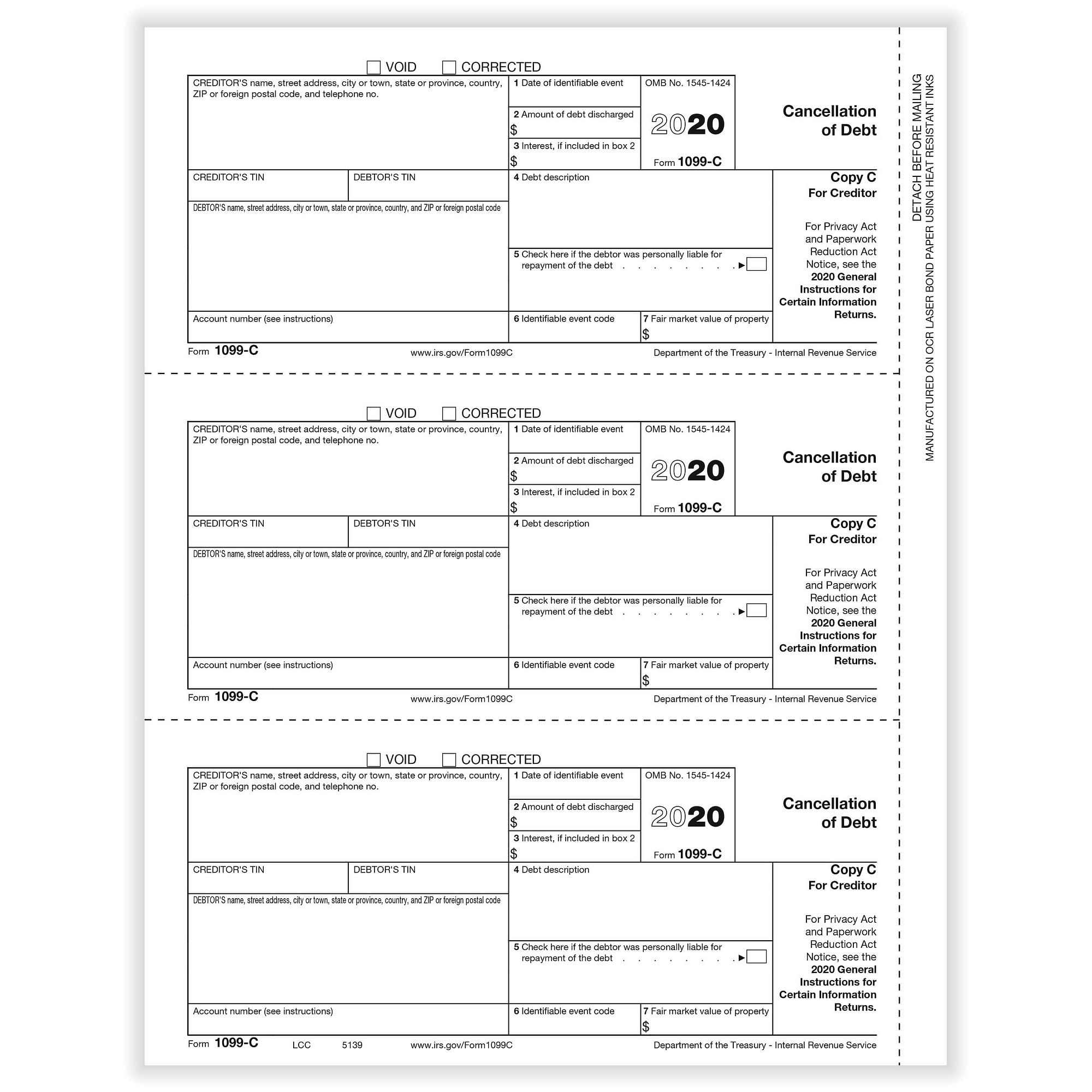

Laser 1099 C Copy C Deluxe Com

Office Supplies 1099 C Federal Copy A For 50 Recipients Forms Recordkeeping Money Handling

What Is A 1099 Tax Form Guide To Irs Form 1099 Mintlife Blog

Official 1099 Forms At Lower Prices Zbpforms Com

fed05 Tax Form Depot

1099 C Forms Tax Forms 4 Us

No 1099 C For Forgiven Ppp Loans But This Tax Form Still Issued In Other Taxable Canceled Debt Cases Don T Mess With Taxes

1099 C Tax Form Copy A Laser W 2taxforms Com

1099 G Tax Form Ides

Doordash 1099 Taxes And Write Offs Stride Blog

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

How To Fill Out And Print 1099 Nec Forms

1099 Misc Miscellaneous Income Payer Copy C 2up

Filing Your Taxes Think About The 1099 C Tax Consequences Loan Lawyers

1099 C Cancellation Of Debt Creditor Or State Copy C Cut Sheet 500 Forms Pack

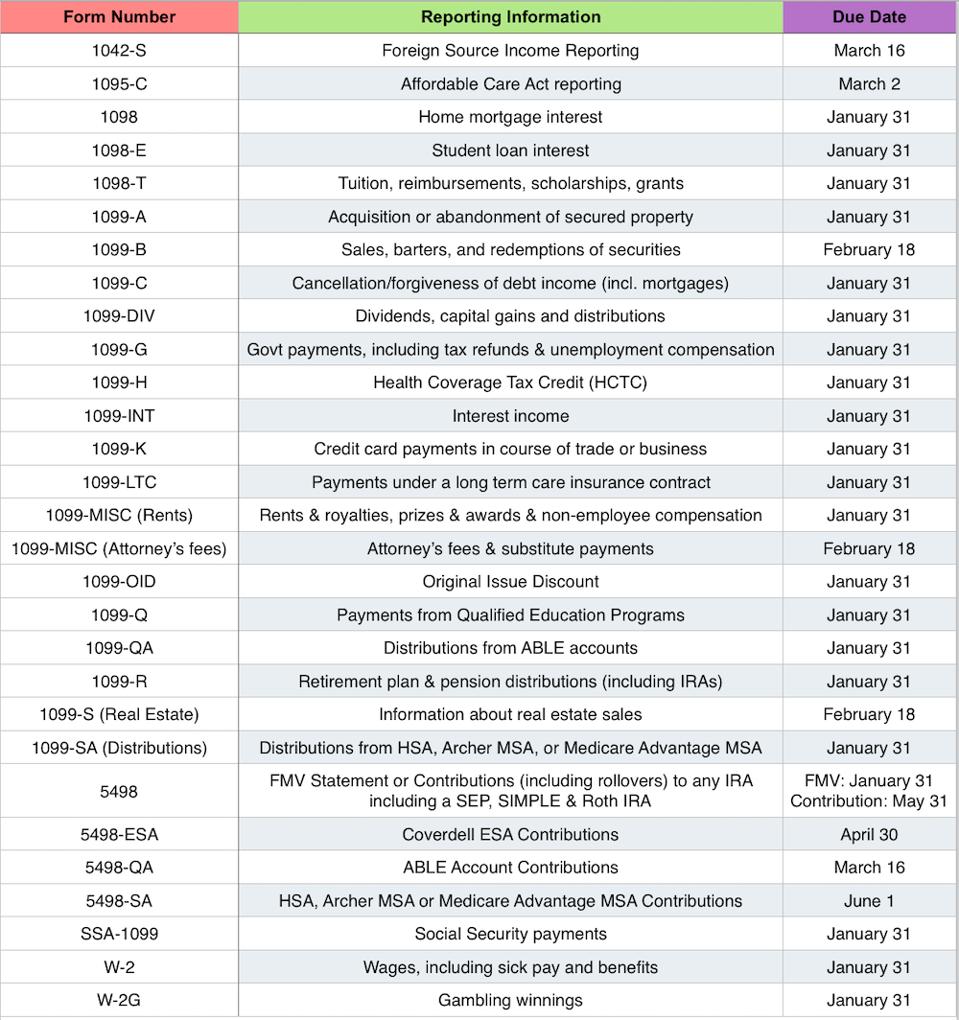

Due Dates For Tax Forms Like Your W 2 1099 And What To Do If They Re Missing

Nec5112 2 Up 1099 Nec Laser Payer State Copy C Tax Form With Nec Non Employee Compensation New Form

Office Supplies 1099 C Federal Copy A For 50 Recipients Forms Recordkeeping Money Handling

Form 1099 Int Irs 1099 Misc 1099 Misc Copy A

1099 Nec Form Copy B C 2 3up Discount Tax Forms

pay05 Tax Form Depot

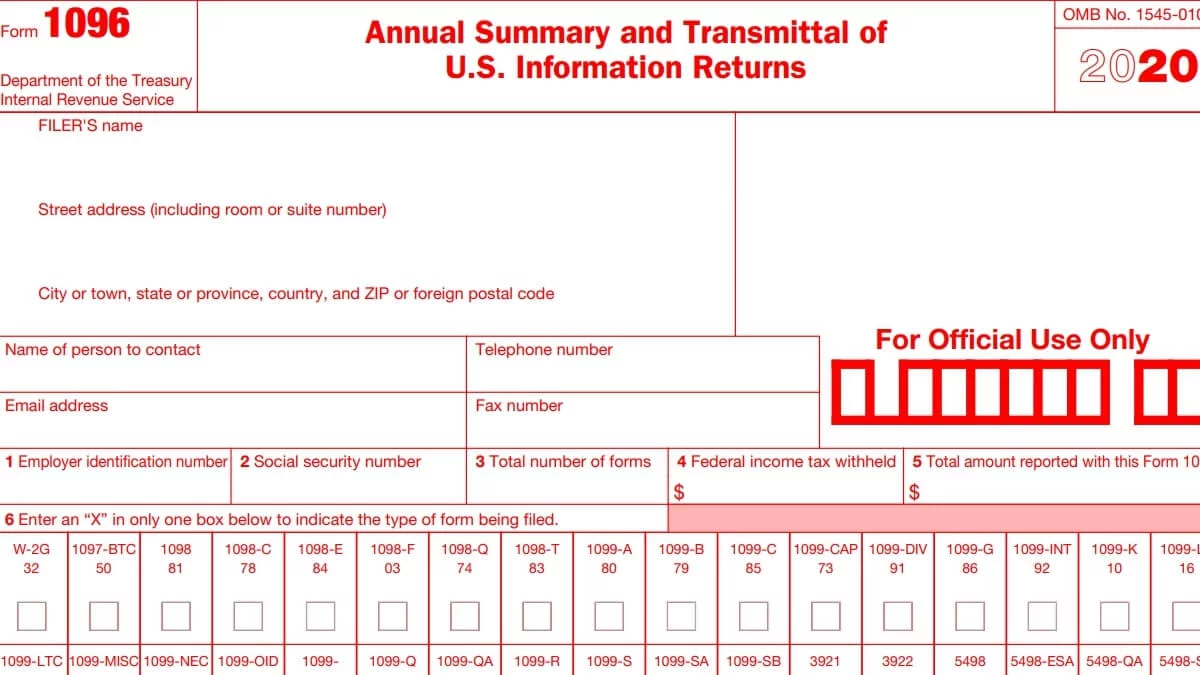

1096 Form 1099 Forms Taxuni

1099 C Cancellation Of Debt 4 Part 1 Wide Carbonless 0 Forms Pack

Irs 1099 C Form Pdffiller

1099 C Carbonless 4 Part W 2taxforms Com

1099 Misc Form Copy C 2 Recipient State Zbp Forms

What S A 1099 C And How Does It Apply To Your Debt Loan Lawyers

Cancellation Of Debt Form 1099 C What Is It Do You Need It

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

About Form 1099 C Cancellation Of Debt Plianced Inc

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

The 1099 C Tax Consequences Of Debt Settlement South Florida Reporter

Horizon Software Firetax

1099 Changes In Pioneer B1 Sap Business One Software

What Is Irs Schedule C Business Profit Loss Nerdwallet

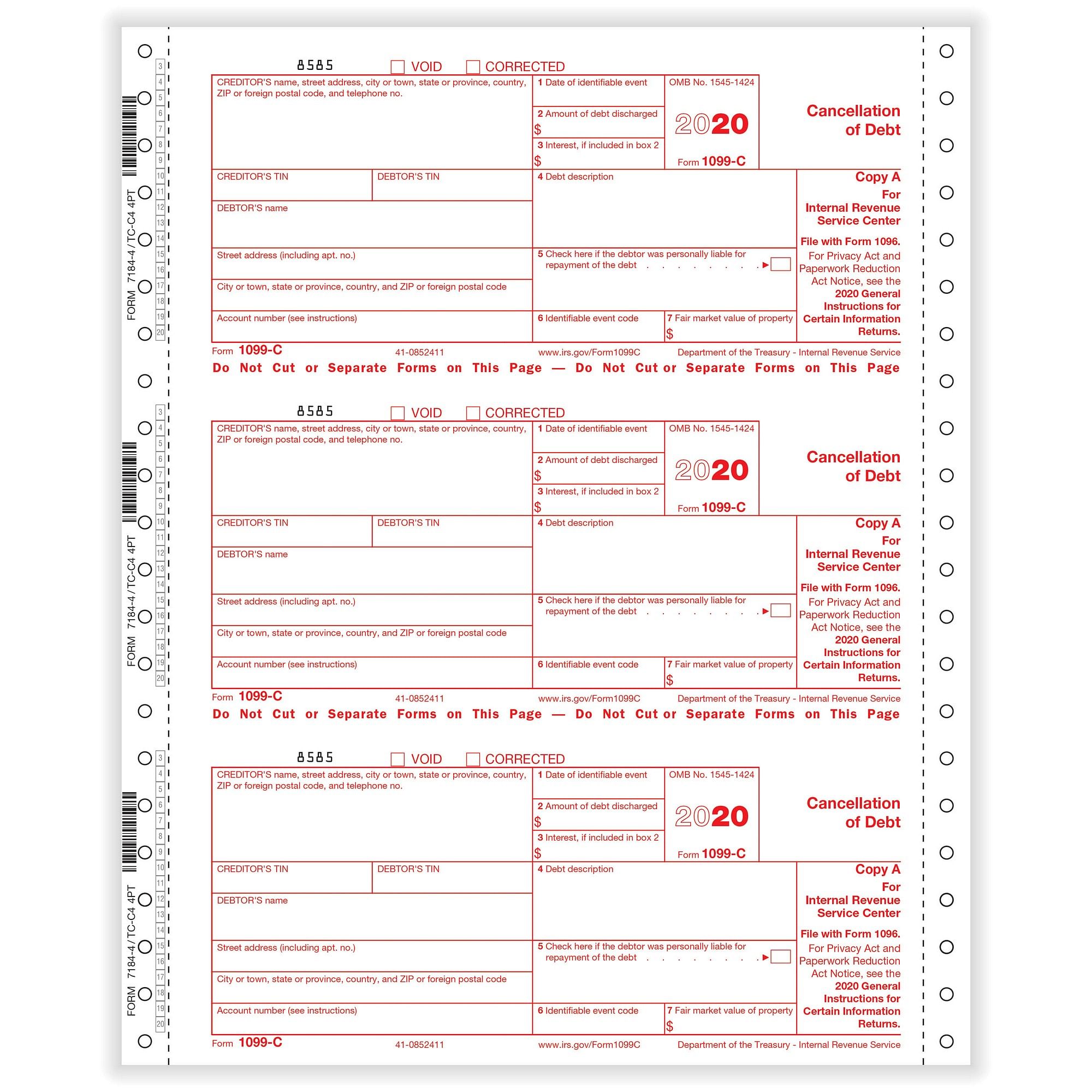

Tf7184 Continuous 1099 C 4 Part Carbonless 8 X 3 2 3

Tf5112 Laser 1099 Miscellaneous Income Payer State Copy C 8 1 2 X 11

E File Form 1099 With Your 21 Online Tax Return

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Misc Copy C State Laser W 2taxforms Com

Amazon Com Egp 1099 Misc Payer Or State Copy C Irs Approved Laser Quantity 3000 Forms Recipients 1500 Sheets 3 Cartons Office Products

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

1099 Misc 4 Part Tax Forms Kit 25 Count Blue Summit Supplies

Do Llcs Get A 1099 During Tax Time Incfile

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

1099 C Federal Copy A For 50 Recipients Forms Recordkeeping Money Handling Human Resources Forms

1099 C Cancellation Of Debt Will You Owe Taxes Credit Com

1099 Misc Form Fillable Printable Download Free Instructions

Tf7184 Continuous 1099 C 4 Part Carbonless 8 X 3 2 3

1099 C Software To Create Print E File Irs Form 1099 C

1099 C Debt Forgiven But Not Forgotten Credit Firm

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Irs Form 1099 C Download Fillable Pdf Or Fill Online Cancellation Of Debt Templateroller

1099 Nec 4 Part Tax Form Kit

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

什么是irs 1099 C表格 商业 21

1099 C Public Documents 1099 Pro Wiki

Walk Through Filing Taxes As An Independent Contractor

Calameo Irs Instructions For 1099a C

Form 1099 Misc To Report Miscellaneous Income

My Ex Says I Need To Claim 1099 C But I Don T Think So

All You Need To Know About The 1099 Form 21

0 件のコメント:

コメントを投稿